Comparing Japanese and US Anime Viewership: Spring 2024

by Miles Thomas Atherton,Anime — animated television and film produced in Japan — is a cultural product that, like Champagne wine or Jollibee, has transcended its country of origin to become an international delight. But just as with those cultural products from France and the Philippines, it is perceived and consumed differently abroad than in its home country. By my best estimates, there are more people who watch anime in the United States than in its native Japan. This is almost exclusively due to the gargantuan size of the USA — the rate of viewership is still much higher in its home country, but this context does help to explain how the majority of anime revenue in recent years has come from overseas sales according to reports from the Association of Japanese Animations.

With that increasingly meaningful international role in the anime space, it's worth examining how the medium is consumed both in and out of Japan. As the biggest market for anime outside of Japan from a financial perspective, we'll explore what viewership patterns look like in the United States using the recent spring 2024 season.

But how do we do this? Most of the data that would make this analysis easy is considered an industry secret. Western streaming platforms dedicated to anime, like Crunchyroll and HIDIVE, have little incentive to expose their viewership numbers to the public. And while Netflix has begun to share some data, it's held back for six months at a time and is heavily aggregated, obscuring behavior, demographics, and inflection points by providing only a single "hours watched" metric.

However, the Japanese model for streaming is a more competitive one, rendering more opportunities for insight. While a handful of TV anime series are locked to platforms like Netflix and Disney+ each year, the other 200 or so new anime series may have exclusive channels for terrestrial television. However, they are broadly platform agnostic when it comes to streaming. In fact, if you look at the Japanese website for pretty much any show, you'll see an exhaustive list of all the different services a show will be available on, with varying prices and holdbacks from the original broadcast. Many of these, like Abema TV and Niconico, reveal viewership numbers. While these platforms don't host every anime, and ideally, we'd combine what they do have with TV ratings (unavailable for the majority of anime) to get the whole picture, this provides us a meaningful enough foundation to work from on the Japan side.

A lack of official numbers on the US side is no deal-breaker when it comes to generating worthwhile estimates. While no longer the majority of anime viewership in the States, bootleg streaming still represents a disproportionate share of fans' connection to their favorite series compared to Western media. Many of these bootleg operations have viewership metrics, publicly or not, that my team regularly tracks and aggregates. Combining data from every available bootleg site with other public data I've found correlative with viewership and trackable metrics on platforms like Crunchyroll allows for a reasonable estimation of the total viewership in the English-speaking world. Applying the percentage of each platform's American traffic allows for both an estimation of US viewership specifically and to fine-tune the formula to account for American tastes relative to the Anglo-sphere as a whole.

To make the comparison as close to an apples-to-apples situation as possible, this analysis gives every anime a "viewership score" out of 100, where 100 is the most popular anime of the season in that country by viewership and an anime's score is its popularity compared to that #1 slot. For example, a "50" would have half the viewership as the most popular title.

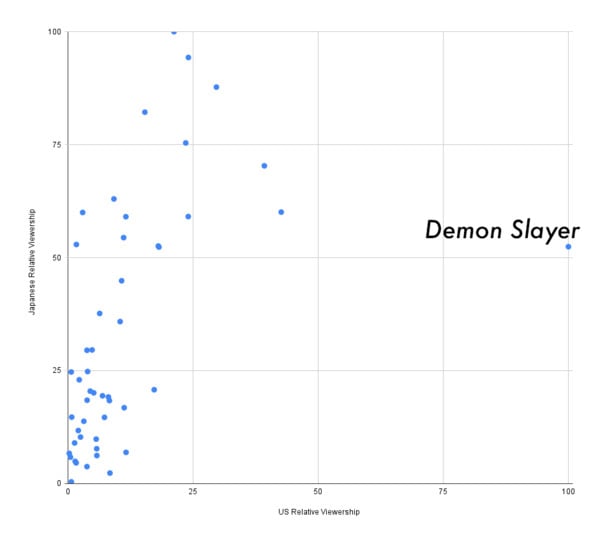

The first version of this analysis looked like this:

Demon Slayer: Kimetsu no Yaiba Hashira Training Arc is so popular in the US compared to every other anime that it distorts the chart. Only three other series would be comparatively more America-centric in this model than in Japan. While this is fundamentally the most accurate way to view the season, its outsized effect obscures other meaningful trends.

Demon Slayer has a fanatic audience in Japan as well, but the furor has dropped from the peak of interest. This is best understood as a consequence of the relationship between anime and manga in each respective country. In Japan, there are more manga readers than anime viewers, so the height of fan engagement surrounded the manga's climax. In the US, anime viewers outnumber manga readers by nearly 2:1, so the scion of Demon Slayer's popularity has thus far been the release of the Mugen Train film in theaters, thus the material in the critically-fraught Hashira Training Arc is new to a much larger percentage of the audience here.

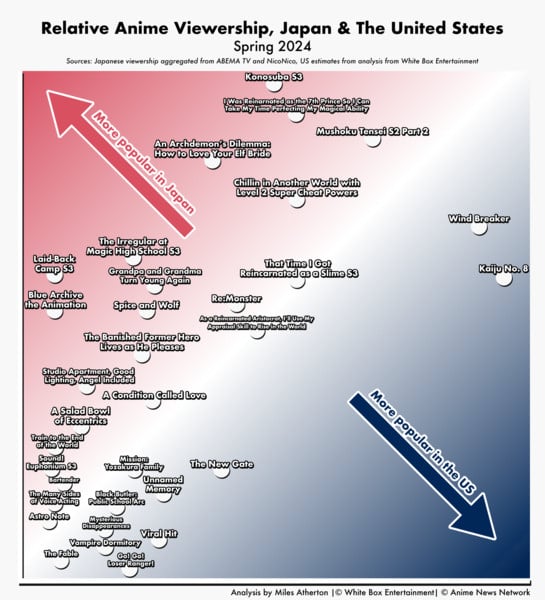

To best understand viewership patterns across the US and Japan, let's view this comparison with Demon Slayer excluded from the mix. The result looks like this:

- Isekai hits everywhere

- High stakes, high concept in America When I first started doing analysis like this during my tenure at Crunchyroll and for the short-lived Japanese magazine Anime Buscience, two of the elements I found across anime that over-performed in the West were "high stakes" storyline and a "high concept" premise. It's not a predictive measure, to be clear: having an anime with a serialized storyline about saving Japan/the world/the universe from destruction is not a guarantee to make a popular anime stateside, but anime that score better in the US than in Japan have consistently had these qualities.

- Character drama over-performs in Japan On the other side of the coin, character drama tends to be more potent for Japanese audiences. Sound! Euphonium Season 3 is amongst the most skewed towards the Japan side of the chart, indicating that the coming-of-age drama surrounding a suite of high school girls does not charm Americans the same way it does Japanese fans.

- Baseball Oblivion Battery is one of the most Japanese-weighted titles in the sample, but its explanation is perhaps the easiest: baseball is much more popular in Japan than in its birthplace. Some national pastime!

- Viewership is concentrated around the top few titles in the US Anime consumption in English-speaking countries is much more top-heavy, centered on the top few series in any given season. 2024's Spring lineup is no exception, with only six titles getting at least half of the viewership of the top show in the model that excludes Demon Slayer, compared to 15 different anime in Japan. This concentration of interest is one of the most important concepts to take away if you want to understand the English-speaking anime community at large.

- Viewership has a complicated relationship with other metrics If my personal X/Twitter feed were any indication, I would have guessed Sound! Euphonium and Jellyfish Can't Swim in the Night were some of the biggest hits of the season. But as we should expect from the algorithmic nature of social media, everyone's personalized feed is just that: personalized. They're fundamentally bubbles, and considering my personal level of engagement with the medium, it makes sense that my feed is more aligned with Japanese fans than with my neighbors in the physical world.

Whether it's sequels like Mushoku Tensei: Jobless Reincarnation II and That Time I Got Reincarnated as a Slime or novel newcomers like Chillin' in Another World With Level 2 Super Cheat Powers and As a Reincarnated Aristocrat, I'll Use My Appraisal Skill to Rise in the World, isekai — a genre of stories about being transported from the real world to a fantasy one — makes up an incredible share of the most popular anime in both countries.

With such unbelievable production of new anime, nearly all major studios in Japan have the next few years of releases lined up in advance. As a result, anime is slow to adjust to new trends, often taking 3-4 years for a studio to have availability to field a pitch that matches the hottest manga or light novel property of today. It's one reason so many isekai anime are being produced: the top 10 titles of 3-4 years ago were overwhelmingly of the genre. With the same trend happening now, I imagine we're in for many years yet of isekai's ubiquity in the medium.

If I had to explain why, I would wager it has to do with how anime became popularized in the West. One of the ways that anime was most starkly different from Western animation when the bulk of US anime fans were growing up was the serialized storytelling, where the outcomes of one episode had meaningful impacts on the next. This distinction defined how many came to view anime more broadly, accurately or not, and became what they looked for when they sought out new anime to watch.

As a Reincarnated Aristocrat, I'll Use My Appraisal Skill to Rise in the World has both of these qualities. The concept of "appraisal," being the special skill that allows the protagonist to be successful in a world of magic and diplomacy, has some build-in allure and mystery, but even more importantly, this anime underscored the stakes of its storyline — a war of succession — more quickly than other spring isekai. Similarly, the brutal murder in the opening seconds of Re:Monster, paired with a somewhat novel alchemy/fantasy biology take on the isekai genre, make for the kind of title you will regularly see recommended based on its concept in American anime circles.

"Chill shows" can occasionally break through in the US, but more typically, iyashikei/slice-of-life titles don't have enough of a hook for Western audiences. Though every episode could reasonably be considered a masterpiece, Laid-Back Camp's third season was barely a blip in the public consciousness of American anime fans and had an even smaller actual weekly audience. Similarly, Studio Apartment, Good Lighting, Angel Included and Grandpa and Grandma Turn Young Again were not unpopular by any means in the US, but proportionately, both were amongst the most Japan-centric titles.

This also helps explain Japan's outsized viewership for An Archdemon's Dilemma - How to Love Your Elf Bride. Fantasy anime perform well across borders, but with so many different entries in the genre this season, it's no surprise that the series with some of the lowest stakes would be the least popular proportionately.

This character focus, as opposed to plot-driven content, is a common theme across anime on the Japanese side of the line. Bartender Glass of God, Whisper Me a Love Song, Train to the End of the World are all centered on their character's inner struggles. That's not to say this isn't a key element of other anime, but the titles that tend to over-perform in the US are certainly more plot-driven, on average.

One of the broadest generalizations I can give for why these titles do not perform as well overseas as they do at home relates to the above explanations about why Americans prefer the big-stakes storylines: Americans prefer the anime that were most likely to be localized in the era before streaming. We've been conditioned, broadly, to understand anime as having the characteristics of the titles shown on Toonami and Syfy (back when it was called the Sci Fi Channel), and that informs what anime tend to perform best even now.

In all seriousness, sports anime has historically been more popular in Japan than in the US, but this gap has been closing year by year. Blue Lock is one of the best-selling manga in the US, and titles like Haikyu!! and Hajime no Ippo are helping to bring greater attention to the genre.

Japan's more linear progression of viewership is more reflective of organic behavior seen in America's Nielsen ratings or even on Netflix's weekly top 10 lists. A standout or two at the top isn't strange, but the nearly logarithmic progression of the US viewership isn't just about marketing: it's also about what anime break through to "wide" audiences. A key trend I've found in my company's regular surveys and focus groups is that the massive influx of new and returning anime viewers in the States generated during the pandemic are less likely to be characterized as "seasonal" anime viewers, with less of a focus on newly-airing titles outside of tentpoles.

Marketing is likely to have played a meaningful role here as well. From my research, the median anime did not receive any dedicated PR push or paid media, nor did it show up as a 20-foot shrine on the side of one of the convention booths for the spring season in the West. While less popular titles would occasionally see a clip posted on the Crunchyroll YouTube or a dub announcement on HIDIVE's Facebook page, of the 48 titles in this comparison, I was unable to find any specific marketing initiatives beyond that, even using third-party tools to trawl the tens of thousands of non-indexed digital efforts.

As the sole distributor for more than 40 new anime released this spring in the English-speaking world — nearly 80% of the season — Crunchyroll is necessarily at the center of this dynamic. From a practical standpoint, it's nearly impossible to promote a lineup similar in size to the prime-time releases from legacy networks like NBC or CBS, particularly when the turnover between titles happens consistently on a quarterly basis, and the ownership of the titles is more complex.

On Crunchyroll's owned platforms, the curated app experience highlighted season standouts like Wind Breaker and Kaiju No. 8 multiple times across multiple categories, both within the procedurally generated "Top Picks for You" style groupings (regardless of actual viewership, from my anecdotal analysis) and those assembled with a human touch. Rarely, if ever, did I find my personal favorites of the bunch like Sound! Euphonium or Train to the End of the World in anything beyond the "Recently Updated" category, least of all in a way that felt like the streaming platform was actively encouraging me to watch it.

That said, I do think much larger US audiences would have taken to titles like The Fable and Mission: Yozakura Family had there been greater awareness of their existence, much less their qualities. According to Digital TV Europe, in 2019, Crunchyroll subscribers were watching an average of 85 minutes a day, a figure that moved to 100 minutes during the height of the COVID-19 lockdowns. Even if that number has reverted all the way to its pre-pandemic benchmark, the average subscriber is watching the equivalent of more than three episodes of anime a day. I have to imagine this volume of anime viewership provides more opportunities for a greater diversity in anime watched with the right encouragement.

Japanese home video sales are frequently touted as a "make-or-break" metric for anime in fan spaces in the West, but their impact is typically overstated. One of the most viral anime-related "news stories" of the year so far on Facebook and Instagram was related to Solo Leveling's comparatively poor showing in the Blu-Ray and DVD market, with commentators broadly agreeing that this was an indication of the title's lack of success in Japan. However, home video accounts for only ~3% of the domestic anime market in 2024, so its centrality in discussions is a bit misleading. Similar narratives have come up with Kaiju No. 8 this season in the wake of recent reports of its comparatively lackluster volume 1 stats, but as represented by the chart, they are not representative of the viewership of the title.

Using websites like MyAnimeList or AniList to gauge the popularity of an anime has some value, but it skews the results towards the type of anime fans who use them, which is anything but representative. My own survey results show these audiences have wildly different tastes than both the median anime viewer and the median "hardcore" viewer. Outside of the extremes at the top and the bottom, aggregators don't reliably show the relationship between anime. I do understand that folks gravitate towards these public metrics because they're all that's available, but I do want to caution against reading too much into them all the same.

I hope this analysis has been helpful in understanding the differences in anime engagement between the US and Japan. I'd love to hear your thoughts on the trends represented here in the forums. Thanks for reading!

Editor's Note: Miles is the head of White Box Entertainment, a consulting firm with clients including anime distributor REMOW (licensor for Hey! Tonbo!).

Miles Thomas Atherton is the CEO and founder of White Box Entertainment, a consulting firm focused on the promotion and analysis of anime and manga in the English-speaking world. He was previously the Chief Marketing Officer of Anime Ltd., a boutique anime distributor in Europe. Before that, he spent nearly a decade at Crunchyroll across a half dozen roles, ending his tenure as the Director of Social Media, Editorial, and Curation.

You can reach him at [email protected].

discuss this in the forum (37 posts) |